MONTGOMERY, Ala. — Alabama Attorney General Steve Marshall has joined a coalition of 10 Republican-led states in suing BlackRock, Vanguard, and State Street, accusing the asset management giants of illegally conspiring to manipulate coal markets through climate-focused initiatives. The lawsuit, filed in Texas federal court, frames the companies’ adoption of environmental, social, and governance (ESG) goals as harmful to free-market competition and burdensome to energy consumers.

Marshall announced Alabama’s participation last week, aligning with states like Texas, Missouri, and West Virginia in what is being described as one of the most high-profile challenges to corporate climate strategies. The suit alleges the companies used their influence as major shareholders in coal companies to artificially reduce production, thereby driving up energy prices.

However, the AGs’ use of the term “woke” to criticize the corporate decisions has raised eyebrows. Originally coined within Black communities to mean awareness of social injustice, “woke” has increasingly become a pejorative used by conservatives to criticize progressive policies. Critics say its application here—targeting firms for acknowledging established climate science—underscores how polarized discussions of environmental policy have become.

BlackRock, Vanguard, and State Street, which collectively manage over $26 trillion in assets, have long been a focal point for criticism from the political left due to their massive influence on global markets and perceived prioritization of profit over social responsibility. However, their recent commitments to align with initiatives like Climate Action 100 and the Net Zero Asset Managers initiative have made them targets for conservative officials as well.

It’s a strange dichotomy, BlackRock has been viewed as a bogeyman by progressives for its corporate dominance. Now, it’s being castigated by conservatives for simply incorporating well-established climate science into its business model.

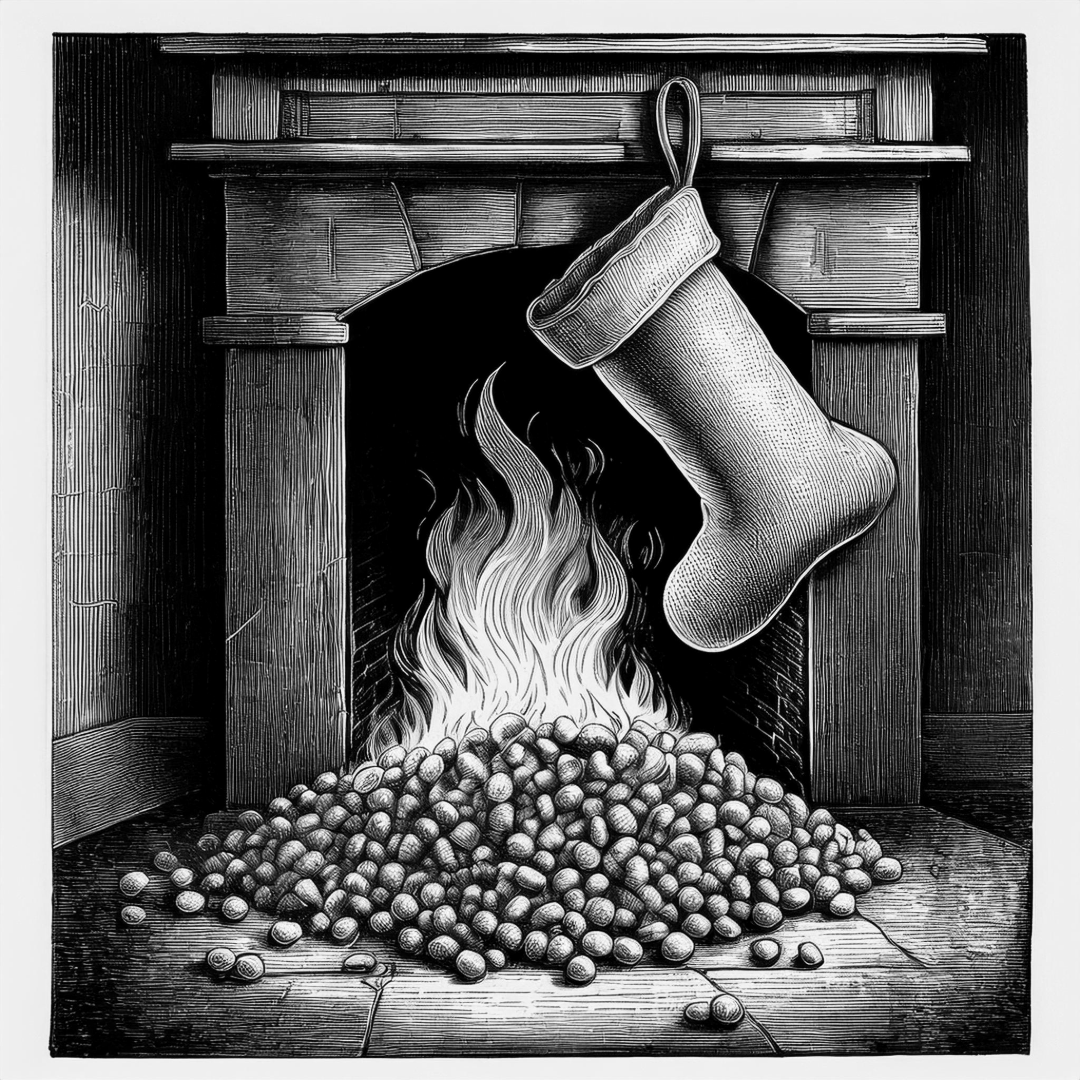

The lawsuit alleges that the firms colluded to reduce coal output by 50% by 2030, citing environmental goals that would lower carbon emissions. The coalition claims this “artificially depressed” supply has led to higher electricity costs for consumers while enabling the firms to reap financial rewards from increased energy prices.

The case reflects broader tensions over how businesses respond to climate change. The Intergovernmental Panel on Climate Change (IPCC) and other scientific bodies have emphasized the need for urgent action to reduce carbon emissions, a stance increasingly integrated into corporate strategies worldwide. For Republican leaders like Marshall, however, such moves are framed as overreach and antithetical to market principles.

Environmental advocates argue that the lawsuit is emblematic of a refusal to grapple with scientific realities. Accepting basic climate science is now being branded as “woke.” These companies are making rational business decisions based on the future risks of climate change..”

In Alabama, where coal has historically been an economic staple, the lawsuit taps into lingering tensions over the state’s energy future. Coal production and related industries have declined sharply in recent years, and the state’s utilities have faced pressure to modernize energy portfolios.

This lawsuit plays well politically because it evokes nostalgia for coal’s heyday while deflecting attention from the economic realities of a changing energy landscape. But the broader question remains: How will Alabama position itself in a world increasingly moving toward renewables?

As the case proceeds, it’s likely to draw national attention for its potential to reshape how businesses balance climate responsibility with shareholder interests. For Alabama, the stakes go beyond the courtroom, touching on the state’s economic identity and its role in an evolving energy economy.