Birmingham, AL — Fairway Independent Mortgage Corporation has agreed to a $9.9 million settlement with federal regulators over allegations of discriminatory lending practices in Birmingham’s majority-Black neighborhoods, including Ensley. The settlement comes after an investigation by the Consumer Financial Protection Bureau (CFPB) and the Department of Justice (DOJ) revealed that Fairway engaged in redlining, a practice that denies or limits financial services to certain communities based on racial or ethnic composition.

The investigation found that from 2018 to 2022, Fairway made disproportionately low numbers of mortgage loans in majority-Black areas compared to its peers. Only 3.7% of Fairway’s mortgage applications were for properties in these areas, while peer lenders averaged 12.2%. This disparity raised concerns about potential violations of the Fair Housing Act and the Equal Credit Opportunity Act.

As part of the settlement, Fairway will pay a $1.9 million civil penalty and allocate $8 million to a loan subsidy program designed to increase homeownership opportunities in underserved communities. Additionally, Fairway has committed to opening a new branch in a majority-Black neighborhood and enhancing its community outreach efforts through financial education programs.

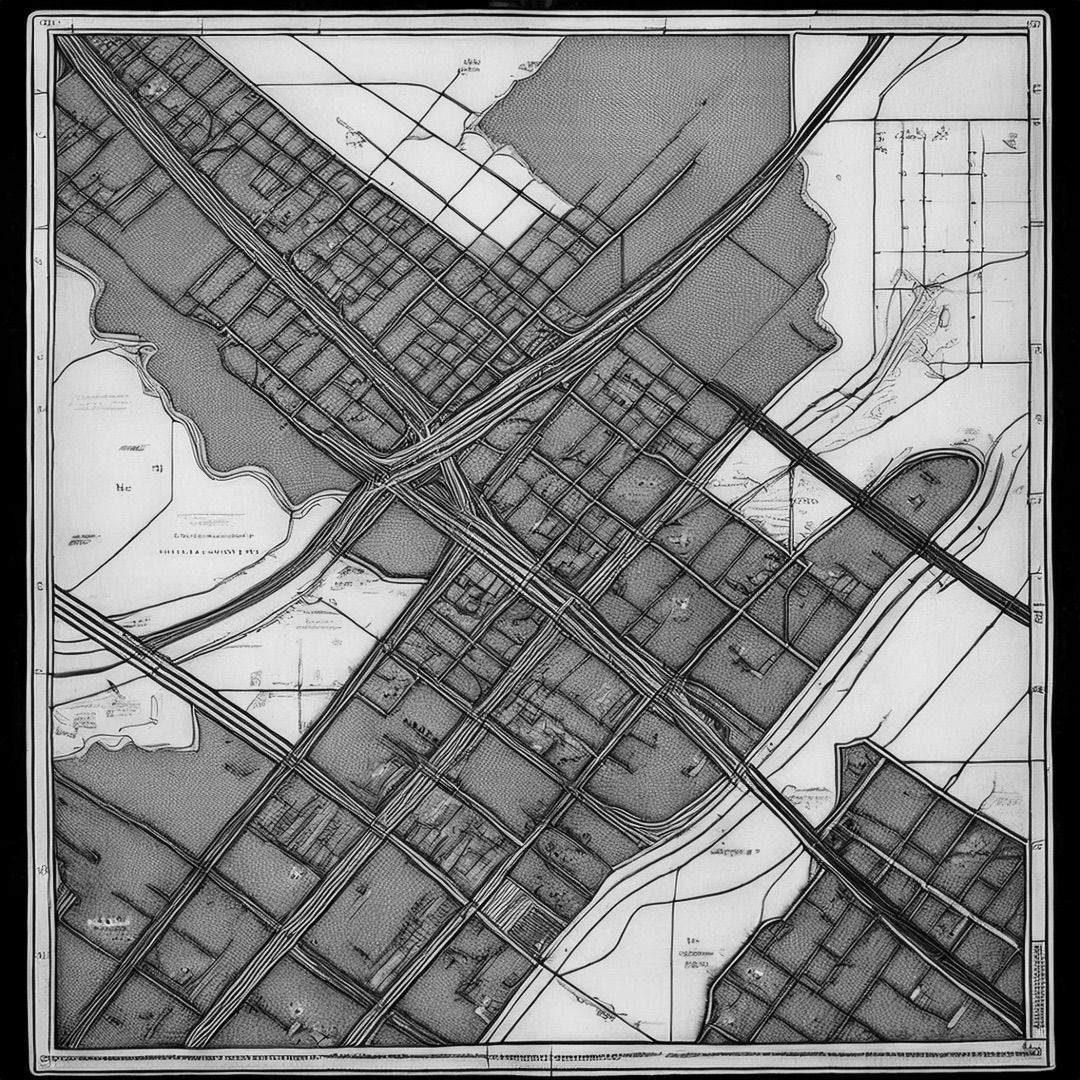

Birmingham, a city with a rich civil rights history, has long grappled with the legacy of redlining—a practice that dates back to the early 20th century when maps were drawn to delineate areas deemed “risky” for investment, often based on racial demographics. These practices have contributed to economic disparities and hindered generational wealth building in Black communities.

The settlement with Fairway marks a significant step towards addressing these historical injustices and promoting equitable access to financial services. By investing in community development and education, Fairway aims to rebuild trust and foster economic growth in Birmingham’s historically marginalized neighborhoods.

This case underscores the ongoing challenges of combating racial discrimination in lending and highlights the importance of regulatory oversight in ensuring fair access to financial services for all communities.